Trump’s latest Hollywood “hit” isn’t the kind you stream.

Threatening to slap a 100% tariff on films produced in foreign countries, the president’s announcement rattled several media stocks like Netflix, Inc. (NFLX), Walt Disney Co. (DIS), and others.

What makes the whole thing complicated is this:

- No clear-cut definition of “foreign”: Many “American” films are shot abroad with foreign crews, locations, and studios.

- Tax breaks abroad: Studios rely on international incentives to cut costs—think Marvel in the UK or Netflix in Korea (Squid Game).

- Global revenues: Delivering content overseas boosts subscriptions.

- Disruption to current projects: In-progress shoots and cross-border production deals could face sudden delays, cancellations, or financial penalties.

- And last but not least, retaliation risk. Countries may hit back with tariffs or restrictions on U.S. films, hurting global revenues.

The result? A policy that aims to protect American film could end up undercutting it from every angle.

Which Media Stocks Are Still Worth Holding?

With Trump’s proposed 100% tariff and the looming threat of retaliation, you’re probably wondering: Which media stocks are still investable—and which ones are caught in the crossfire?

Let’s focus on the platforms that most Americans stream at home.

- Netflix (NFLX) is the most exposed to Trump’s tariffs due to its heavy investment in international productions.

- Disney (DIS) is most vulnerable both ways—to the U.S. tariff and international retaliation—in that over 60% of its box office revenue is international; plus, it operates theme parks in China, Hong Kong, Japan, and Europe.

- Roku (ROKU) appears to be the least exposed, as it’s a content aggregator and not a producer. The bulk of its revenue comes from advertising, subscriptions, and platform fees, not from producing or exporting content.

NOTE: I’m excluding Amazon (AMZN) in favor of pure-play media entertainment stocks. While Amazon is not as exposed to foreign film tariffs, it’s exposed to the other tariffs.

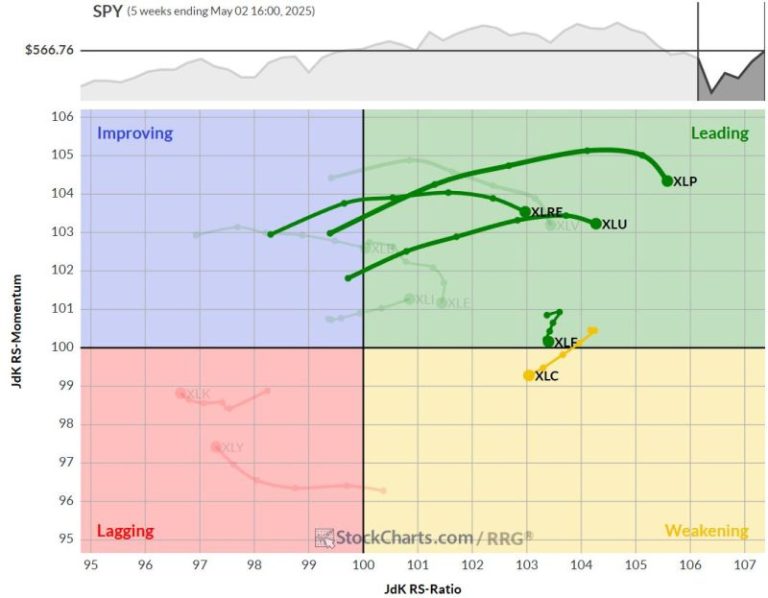

First, how are these stocks performing relative to each other and the broader market (S&P 500)?

FIGURE 1. PERFCHARTS DISPLAYING THE RELATIVE PERFORMANCE OF ALL THREE STOCKS VS THE S&P. Netflix is far outpacing its two media peers.

Among these three, which stocks are currently the most investable—that is, which ones are showing favorable price action that could support a viable trading setup?

Netflix Technical Analysis: Uptrend Intact, But Caution Ahead

Let’s start with NFLX—the company most fundamentally exposed to the proposed tariffs on foreign-made films. Check out this daily chart.

FIGURE 2. DAILY CHART OF NFLX STOCK. No tariff fears are evident here as the stock continues its uptrend.

NFLX stock remains in a strong uptrend, with a StockCharts Technical Rank (SCTR) well above the 90-line, making it one of the top-performing large-cap stocks from a technical perspective. However, the Relative Strength Index (RSI) suggests the stock may be overbought, raising the possibility of a short-term pullback.

The 20-day Price Channel can help identify potential turning points since it highlights recent tops and bottoms. The green-shaded zone marks the first area of support, where a bounce may occur if the stock retreats in the coming sessions. If that level fails to hold, the red-shaded zone identifies a secondary support area aligned with the 200-day Simple Moving Average (SMA). A drop below this level without a strong rebound could signal a weakening of the current bullish trend.

Caution: Among the three stocks analyzed, Netflix appears to be most exposed to potential downside from Trump’s proposed tariffs on foreign-made films. Investors should remain cautious, as shifting geopolitical dynamics could alter the stock’s fundamental outlook and technical setup.

Now let’s take a look at Disney, a stock vulnerable to Trump’s proposed 100% tariffs on foreign-made films and the added threat of retaliatory tariffs from international markets.

Disney’s Recovery Potential Faces Global Headwinds

With a significant portion of its revenue coming from global box office sales and international theme parks, DIS stock is particularly sensitive to shifts in global trade policy. Take a look at this daily chart.

FIGURE 3. DAILY CHART OF DISNEY STOCK PRICE. Oof. Even if it recovers, will we see a breakout beyond the top range?

Disney is underperforming, and the key question is whether the stock is entering a potential recovery phase. The Full Stochastics Oscillator tends to mirror the stock’s cyclical movements well and suggests a possible short-term pullback.

If DIS holds above its most recent swing low support range (highlighted in red), the stock may attempt to retest the resistance area (highlighted in green), which aligns with the 200-day SMA and the most recent swing high.

One bullish signal to note: the Accumulation/Distribution Line (ADL) (shown in orange) is significantly above current price levels, suggesting that buying interest may be quietly building even while the stock trades near its lows. Is DIS a solid buy? Probably not at these levels. You will want to see a stronger indication (or confirmation) that DIS is recovering.

Also, note that DIS has been cycling the $80 to $125 range over the last three years. Unless you’re holding it as a dividend stock, there’s little indication yet that there’s going to be growth beyond this exceedingly wide range.

Is Roku Ready to Break Out, or Break Down?

Let’s analyze the daily chart of Roku.

FIGURE 4. DAILY CHART OF ROKU STOCK. It’s gearing for a breakout, but driven by what?

ROKU may be the least exposed to the proposed foreign film tariffs, but what’s going to drive it higher? Remember, the stock plunged in 2022–2024 due to falling ad revenue, widening losses, and a high-profile cybersecurity breach that shook investor confidence. Without a clear reason for a rebound, the stock may remain stuck.

The Chaikin Money Flow (CMF) is probably the most telling indicator here: buying and selling pressure are at a virtual standstill. There has to be a compelling catalyst to move the stock higher or lower. Still, ROKU appears to be rebounding from a technical standpoint, with overhead resistance levels at $71 and $82.

However, there needs to be something fundamental to validate this technical setup, especially if it turns bullish (like a break above resistance). So if for any reason you’re bullish on ROKU, monitor the fundamental side of this stock play. Right now, it doesn’t look very promising.

At the Close

Trump’s proposed tariff on foreign-made films has stirred up more than just Hollywood headlines; it’s forcing Wall Street to reassess risk across streaming and media stocks. Keep monitoring the technical, fundamental, and geopolitical factors. Don’t make any decisions until you see clear technical confirmation backed by a viable fundamental catalyst. And remember, geopolitical dynamics can still shift the conditions in an instant.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your personal and financial situation, or without consulting a financial professional.